We pride ourselves on building modern financial tools and services that meet the needs of today’s working Americans all year long, but April is a special time at Branch. First designated as Financial Literacy Month in 2004, April has since evolved into Financial Capability Month, and highlights the importance of prioritizing habits, tools, and resources to help manage one’s finances and plan for the future.

It’s also become a tradition around every April to introduce a new tool that empowers workers to better manage their finances. In previous years we’ve launched My.Branch, a content hub packed with personal finance tips and education and Branch Rewards, a rewards program that helps workers earn cash back from everyday spending with their Branch Card.

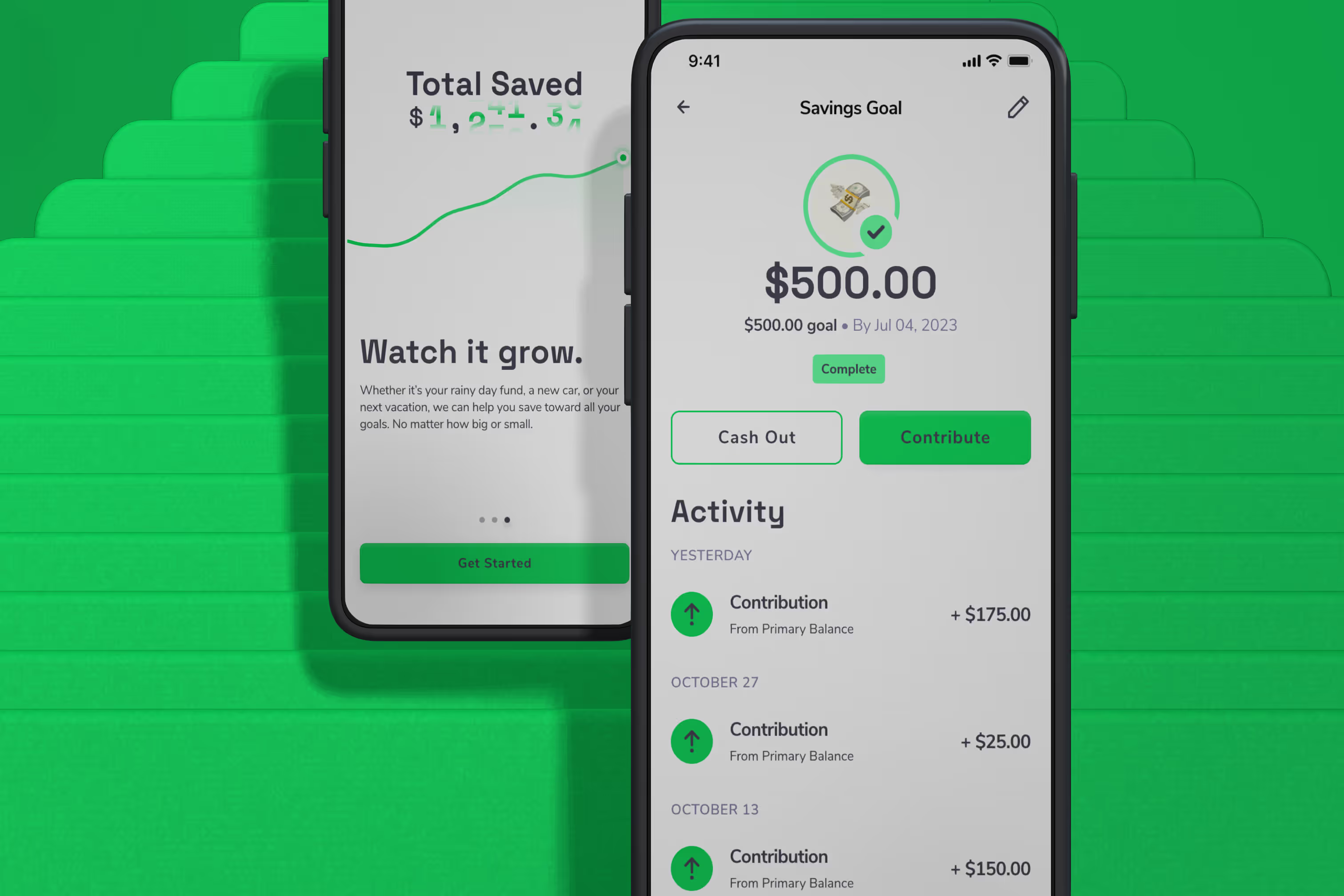

This year, we’re thrilled to expand our suite of personal finance tools with the introduction of Savings Goal, a new feature that helps workers save for the future and prepare for the unexpected. Savings Goal puts workers in control of their financial future with an easy-to-use savings-building tool directly integrated into their Branch Wallet.

Whether it’s setting aside funds for essentials like gas to get to work or longer term goals like an emergency fund, the new feature allows users to simply set a savings goal, put aside funds, and track their progress toward achieving it.

Building a cash cushion.

Unforeseen expenses happen, and our most recent Branch Report found that nearly half of hourly workers (48%) had $0 saved for an emergency. Financial stressors like these crowd out workers' ability to perform well at work, but having a cash cushion helps alleviate some of that stress and provide peace of mind.

Preparing for the future.

Unexpected turns don’t have to throw your team off course. No matter how big or small, workers can create a goal, set a date to achieve it, and track their progress all within their Branch Wallet.

Staying flexible for the unexpected.

While funds moved into Savings Goal are securely stashed away from workers’ primary balance so that they don’t inadvertently spend them, there’s still the option to tap into those funds during unexpected emergencies. Workers can easily transfer those funds back to their primary balance at any time, free of charge.

Workers can also choose auto-contributions, a set-it-and-forget it way to make setting aside money for their goals even easier. We provide the option to choose from daily, weekly, bi-weekly, or monthly auto-contribution options depending on a workers' individual preferences.

Savings Goal is available to all Branch users now. To learn more about setting up Savings Goal, check out this FAQ.

Personal finance tools like Savings Goal, coupled with the ability to receive faster payments—including on-demand pay, instant contractor payments, or instant tip payouts—can help create more financially capable and resilient workers. To learn more about how Branch can help deliver financial wellness tools and faster payments to your workforce, check out our financial wellness offerings or request a demo.

*Savings Goal is a feature in the Branch Wallet that allows users to set aside money for a savings goal. With this feature, they can determine the amounts, dates and funds movement to and from the savings goal balance. Amounts moved to their savings goal will no longer appear on their available balance, but they will have control to move the funds at any time. Additional terms may apply to the savings goal feature, which will be disclosed in the Branch app.

Continue reading

Unlock a Happier, More Productive Workforce