Branch v. ADP Wisely: Finding the Comprehensive Paycard Solution That’s Right for You

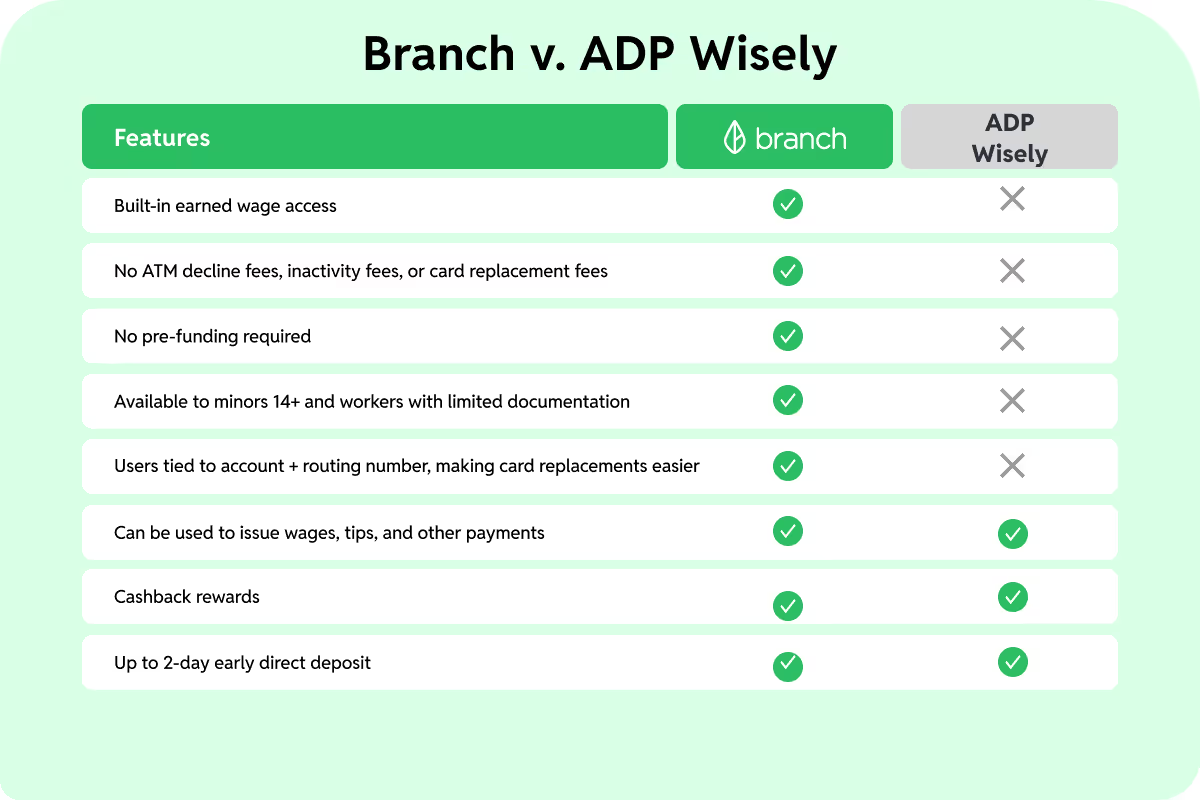

Both Branch and ADP Wisely provide ways for companies to offer fast, flexible payments to workers. They each offer a digital wallet and paycard solution, the cashback rewards, and up to two-day early direct deposit. However, there are some key differences between the two solutions—and understanding these differences can help you find the option that’s best for your business.

Read on to discover how Branch and ADP differ, and what you can expect from each solution.

Branch v. ADP Wisely: Key Differences

Legacy solution vs. modern payments platform

Before we get into the nuances of how Branch and ADP differ, it’s worthwhile to discuss one of the bigger, overarching differences. While Branch and ADP Wisely have similar functionalities, their origins and approaches are distinct.

ADP Wisely is an extension of ADP, the payroll company. Their paycard solution—the Wisely Card— integrates into ADP’s suite of payroll services, though you can use ADP Wisely with other payroll providers, too.

Branch is a comprehensive workforce payments platform that’s not associated with a payroll company. We’re payroll agnostic, meaning that no matter what payroll or time and attendance solution you use (even ADP!) Branch can be plugged into your existing systems. We also offer a paycard solution—the Branch Card—in addition to earned wage access, tips and mileage reimbursements, and other one-off payments.

Built-in earned wage access

In addition to offering a paycard solution and the ability to pay out wages, tips, mileage, and other payments, Branch also offers the option to provide earned wage access to your workforce.

Earned wage access (EWA) allows employees to take an advance of up to 50% of their earnings ahead of time if needed. While both Branch and ADP Wisely can enable EWA, there are key differences in how we handle this functionality.

Branch is a comprehensive payments platform with the ability to pay out wages, tips and mileage, earned wage access, and other one-off payments all from the same platform.

ADP Wisely technically uses their partnership with DailyPay to provide earned wage access (EWA).

There’s nothing inherently wrong with this, but Branch provides a cohesive payments experience that can handle a variety of payment needs from the same platform.

Fees

The way you pay your employees matters. You don’t want it to cost them additional money to access their earnings, or have them incur charges for every little thing. Branch and ADP Wisely each come with different fee structures that we’ll break down next.

In general, as a part of a legacy payroll company, ADP Wisely comes with fees more commonly associated with traditional banking, such as ATM decline fees, card replacement fees, and even an inactivity fee that charges users $4.00 per month after 90 days of inactivity.

Branch takes a modernized approach to financial services, striving to provide as many fee-free options as possible. We do not charge inactivity fees, ATM decline fees, overdraft fees, card replacement fees, or ACH transfer fees. Nor do we have minimum balance requirements. We try to make financial services as accessible as possible to working Americans, and ensure that accelerating payments to your workers doesn’t end up costing them in unnecessary ways.

Pre-funding

Just like your employees don’t deserve to be hit with excess fees or inconveniences, we also think your company should be able to accelerate payments in a straightforward way—one that doesn’t add any additional stress.

If you’re weighing Branch and ADP Wisely for paying out tips to your employees, you’ll want to think about whether or not you want to deal with pre-funding.

ADP Wisely requires employers to tie up capital in a pre-funded account for tip payouts, while Branch does not. We front the money to your workers for the payments instead, meaning you don’t have to take this extra step or worry about trying to guess how much money to set aside to cover the cost of tip payouts.

Available to unbanked workers, workers with limited documentation, and minors ages 14+

When rolling out a new payments solution, you want to be sure it can work for as much of your team as possible. That’s why Branch offers an option for workers who are unable to upload government-issued documents or complete the KYC process. They can still use Branch’s “Essential” account, allowing them to access their pay, and save or spend money with the Branch Card. We can also serve minors as young as 14 years old.

ADP Wisely cannot serve unbanked workers or workers with limited documentation. And while they do offer their services to minors ages 14+, this requires an additional step: They require parental permissions and mailed documentation to enable minors to use their card.

Users tied to account + routing number

Workers that receive a Branch account automatically get an account and routing number that remains unchanged even if they lose their Branch Card or need it replaced. This makes card replacements much simpler, which can be a huge time-saver, especially for companies with a large employee population.

Providing workers with an account and routing number can also equip them with greater freedom and flexibility to manage their finances: they can use the number to set up automated bill payments for expenses such as rent or cell phone bills and link their Branch account to other financial apps and accounts.

With ADP Wisely, when an employee loses their card, payroll needs to go back in and change the card number associated with that user in their payroll system, adding additional manual data entry and tracking.

Branch v. ADP Wisely: Similarities

Handles all types of payments

When you’re looking to accelerate payments to workers, it’s helpful to have options that can fit the specific needs of your team. Both Branch and ADP Wisely can be used to issue a variety of faster payments, such as wages, tips, disbursements, and earned wage access. Although as we mentioned above, the way the two solutions tackle earned wage access differs: Branch is a comprehensive platform with all these tools available in one place, while ADP Wisely uses Daily Pay to offer earned wage access.

Cashback rewards

ADP Wisely and Branch both provide debit cards that come with cashback rewards, a feature commonly reserved for credit cards. This gives workers cash back on everyday purchases made at participating retailers, either in-store and online, and can be an exciting perk to provide workers who may not have access to such a benefit via a credit card.

Up to two-day early direct deposit*

Depending on when your originating bank and payroll schedule, both Branch and ADP Wisely provide the option for you to enable two-day early direct deposit for your workforce. This means that workers can receive their direct deposit up to two days in advance, a separate benefit from earned wage access, which allows them to take an advance of up to 50% of their paycheck ahead of time if needed.

Providing the incentive of two-day early direct deposit can be a great competitive perk to include in job listings, in addition to the other payment tools you’re providing, such as earned wage access, cashless tips, and off-cycle payments such as bonuses, stipends, and more.

*Capability may vary based on originating bank and payroll schedule

Choosing the best payments solution for your team

When deciding which payments solution to choose, it’s important to remember that it has to be something that works for your business and your workforce. You don’t want unnecessary stress, additional hassle, or excess fees to get in the way of providing something that can benefit your company and the people who power it.

Branch’s comprehensive suite of fast, flexible payment offerings can be used to accelerate payments in a way that’s hassle free for everyone involved.

Learn more about the Branch Card or get a free demo here.

Continue reading

Unlock a Happier, More Productive Workforce