The Ultimate Guide To Earned Wage Access (EWA)

Download the The Ultimate Guide To Earned Wage Access (EWA)

Unlock a Happier, More Productive Workforce

Earned wage access (EWA) is a financial benefit that allows employees to access a portion of their earnings ahead of payday, rather than waiting for the traditional two-week pay cycle.

EWA is a way for employees to manage unexpected expenses or cash flow issues without needing to resort to high-interest credit cards or payday loans—two options that often prey on a person’s short-term financial insecurity in order to make long-term financial gain (interest) off of them.

With EWA, employees are simply taking an advance of their own earnings ahead of payday, not locked into any contract or racking up debt.

It’s money they’ve already earned—just on their schedule.

While the two-week pay cycle was considered standard for many years, today’s world demands more. Rising living costs and limited access to emergency savings have created a financial pressure cooker for many Americans—especially those in hourly roles.

With 65% of today’s consumers living paycheck to paycheck, and nearly half of American credit card holders carrying a balance from month to month, it’s clear that for much of the workforce, daily finances are a source of stress.

Earned wage access has emerged as a meaningful way to help people meet short-term financial needs. For today’s companies, EWA isn’t just a nice-to-have employee benefit—it’s a must-have if you want to compete for talent.

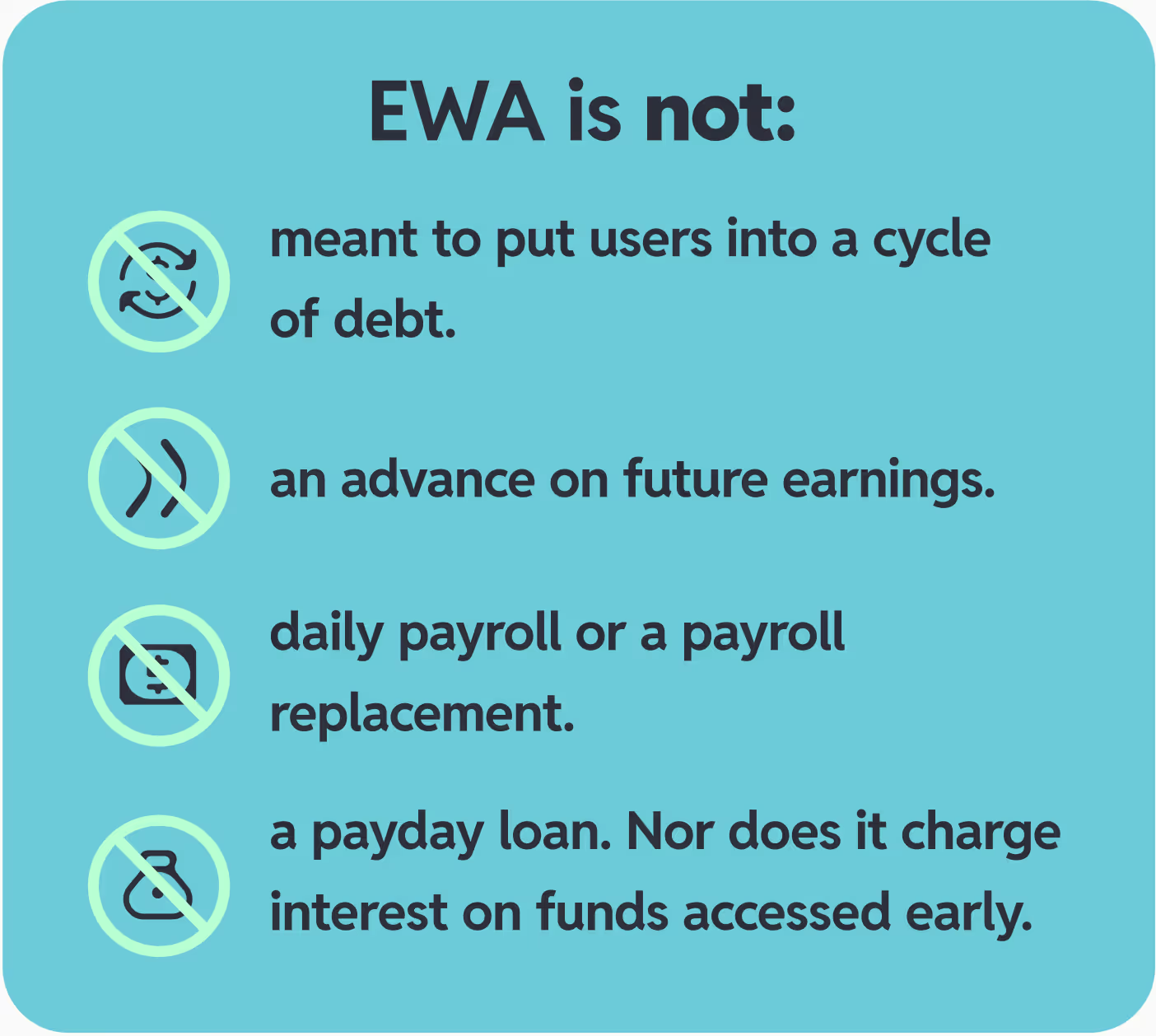

Before we continue, it’s important to address some common misconceptions about EWA. While we just defined what EWA is, here are a few helpful reminders on what it is not.

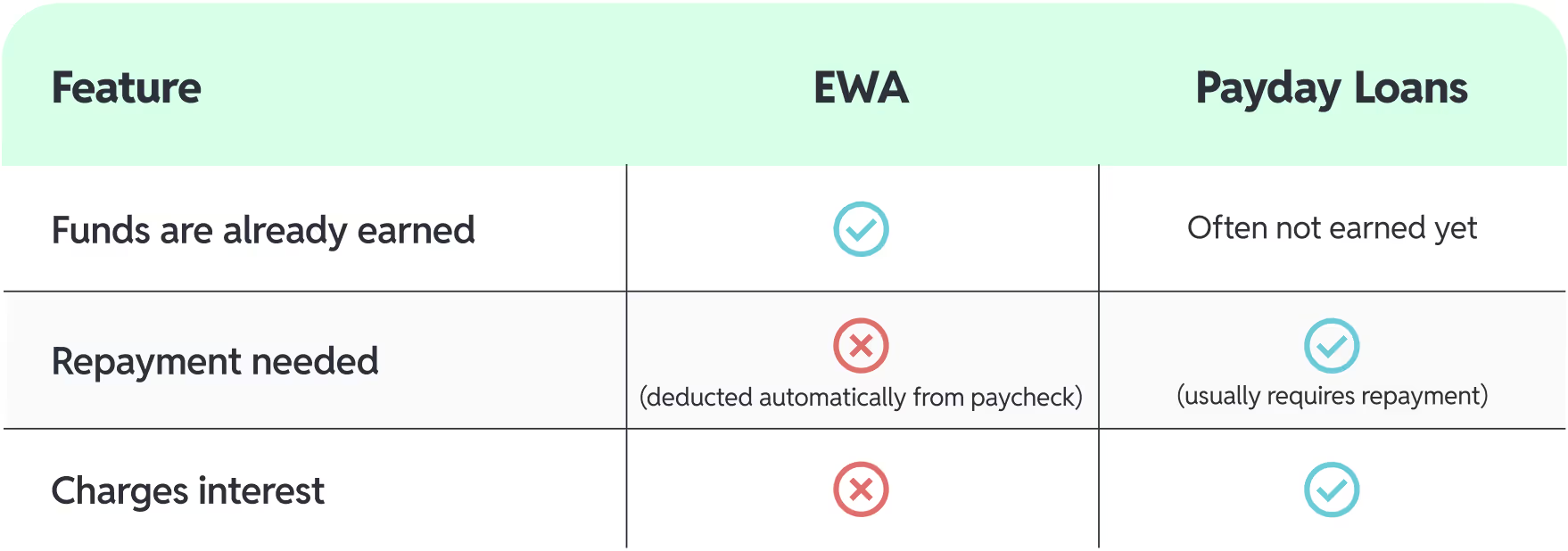

That last point is crucial, because with EWA, you can actually help your employees avoid predatory payday loans. Here’s a helpful chart to break down the difference:

To understand the impact EWA can have on your employees and your company, it’s important to get a sense of how it works in the real world. In other words, what kind of scenario might prompt an employee to use EWA?

Let’s take a look at an example.

An hourly employee (let’s call him Jake) knows he makes approximately $1200 per paycheck. But after receiving his last paycheck—which he spends on monthly rent, cell phone bills, and food—he learns his car needs a minor repair. Jake simply doesn’t have the cash to make the repair, but he needs his car in order to get to work.

Prior to his company’s EWA program, he would have turned to a payday loan to get the repair cash… and entered into a destructive cycle of high-interest loans.

Sounds stressful, right? Naturally, Jake’s work performance would be affected. He might miss work, or quit altogether.

But his company offers earned wage access. Instead of taking out risky, expensive debt, Jake can instead access the wages he’s already earned.

Now, Jake can pay for his car repair and continue showing up for shifts. In fact, thanks to EWA, it’s easy for him to pick up additional shifts. When it’s payday, the wage amount he accessed in advance is automatically deducted from his paycheck.

It’s a smarter, smoother way to access earned wages. And it’s an effective way to turn a potential emergency into a simple, stress-free scenario.

If you can’t tell from the example above, EWA can be lifechanging for your employees. When they have access to wages they’ve already earned but not yet received due to pay schedules they might just…

Studies show that financial wellness correlates with less stress and better health—while financial stress, including high amounts of debt, can put your physical and mental health at risk. Offering EWA is a way to meaningfully impact the lives of your employees—not just their finances, but their holistic well-being.

Financial empowerment doesn’t just benefit your employees—it benefits your company, too. When your employees are better able to manage unexpected expenses and pay fluctuations, your company can thrive. Here are five ways EWA can benefit your business.

On a practical level, it’s not hard to see that financial stress is capable of affecting every area of life—including the workplace. But the data actually backs this up, indicating that financially stressed workers miss more days of work than those who feel confident about their finances.

Not only can EWA help you retain your employees, but it can also help attract new candidates. Listing EWA as a benefit in a job description positions your company as a place that puts employees—and their financial concerns—first.

Take it from Mary Lazzaroni, VP of Human Resources for Manna Hospitality Group, who uses Branch to offer EWA to their employees.

Giving workers flexible access to their pay can motivate them to pick up extra shifts. If they know they can get paid sooner, they may be more likely to say “yes” to helping out. The satisfaction of having money in their pocket at the end of a shift—and at the tap of a button—can go a long way in boosting morale and upping employee engagement.

At Branch, we’ve seen this impact firsthand: One large franchise group we work with, for example, saw a 60% uptick in shift coverage after implementing earned wage access.

Turnover isn’t just a logistical hassle, but a financial headache for businesses, too. Data shows that it can cost a business anywhere from 30% to 200% of an employees’ salary to replace them, depending on their position.

Employers that don’t begin offering benefits like EWA may put themselves at greater risk of having to deal with turnover on a consistent basis. Research suggests that financiallystressed workers are twice as likely to look for a new job; and 60% of workers said they would be more likely to stay at a job if their employer offered financial benefits that helped their day-to-day lives.

Providing financial relief can create a more productive, engaged workforce. A survey from Bank of America found that 80% of employers agree that improving the financial wellness of their employees results in better performance and productivity.

When employees don’t have to worry about making ends meet on a day-to-day basis, they’re better able to focus on what’s in front of them.

Now that you’ve learned how EWA can benefit your employees and your business, you might be ready to explore different EWA vendors.

The first thing you’ll want to discern is how a vendor’s EWA actually functions—not just for your business, but for your employees. While most EWA providers do the same thing, they can operate in very different ways.

When you’re evaluating different platforms and solutions, here are some key elements to examine.

Pricing structures for EWA vendors come in different shapes and sizes. Some popular EWA pricing structures include employer-supported, wallet-based, a membership model, or transaction-based. Here’s a bit of background on each type.

Employer-supported EWA means that the employer pays some or all fees associated with offering EWA.

With wallet-based EWA, neither the employer nor its employees are charged any fees. Instead, employee earnings are deposited into a digital wallet and the EWA provider makes money off of interchange.* This is the model that Branch uses.

A membership or subscription-based model means employees typically pay a recurring fee to have access to the earned wage access feature. The employer can also decide to cover the fees in a membership model if they choose.

The transaction model means employees pay a fee each time they want to access their earned wages.

*Quick note: Interchange refers to the fees paid by a merchant’s bank to a card-issuing bank for each card transaction. They are set by card networks like Visa, Mastercard, and Discover. They are not paid by you or your employees.

An EWA solution is only as successful as it is usable. Any new program needs intuitive onboarding and responsive customer support to help people adopt new technology. Be thorough in asking what kind of support you can expect from a potential EWA provider, and what the employee onboarding experience is like.

Here are some good questions to consider:

How will you know EWA is “working” for your company? How will you show key stakeholders the impact it’s having on your organization? Ask your potential EWA vendor how they plan to measure success with these key questions.

While earned wage access is a great benefit in and of itself, it’s useful to determine if you can unlock more from your EWA provider. Ask a potential provider what other financial wellness tools or resources they offer. Are there other payment processes they can help you streamline? Consider asking the following:

Asking these questions will give you a better sense of what else a potential provider has to offer—and other ways to improve your workers’—and your payroll team’s —payments experiences.

Now that we’ve gained an understanding of what EWA is and why it’s important, let’s go over how Branch’s EWA works, based on the evaluation factors you learned about above.

To start with, Branch uses a wallet-based model, meaning there is no cost to your company and no cost for employees to access their earnings.

With Branch, users can also self-onboard through a mobile app in 90 seconds or less. We offer responsive, U.S.-based support to help users with any questions they may have, eliminating the burden from you.

And when it comes to measuring success, we pride ourselves on walking the talk of how EWA boosts recruiting, retention, and overall employee engagement:

We’ve found that workers with access to EWA stay with that company 60% longer, based on a Branch case study.

And in a survey of one major healthcare customer, 86% of their employees reported feeling more incentivized to go to work because they could get paid instantly.

Not only can Branch help boost recruiting and retention, but we also hear consistent feedback from our customers on how easy it is to get started. Here’s a quick rundown of how your employees can begin using Branch.

Once your business is offering EWA with Branch, your employees can easily access their earned wages.

Here’s how it works:

In just a few simple steps, employees can access wages they’ve already earned and alleviate financial stress. No interest, no debt—just their own earnings, ahead of time.

*Branch is not a bank. Banking services provided by Evolve Bank & Trust, Member FDIC. FDIC insurance only applies for eligible accounts should the bank holding your funds fail. The Branch Mastercard Debit Card is issued by Evolve Bank & Trust pursuant to a license from Mastercard and may be used everywhere Mastercard debit cards are accepted.

We’ve compiled some commonly asked questions about how our earned wage access works. Read on for the answers—or reach out to us at sales@branchapp.com with a question of your own.

When employees start using Branch, they receive a virtual card and an optional debit card (Branch Card). Every time employees use these cards to purchase something, there’s a small transaction fee paid by the merchant. Employees can move their funds from the Branch card to other accounts at any time.

Most employers offer financial wellness benefits aimed at helping employees achieve long-term goals. For example, employers may offer Health Savings Accounts (HSAs) or matching 401K accounts. But these offerings have limitations and restrictions that leave a gap for addressing short-term financial needs. Employers and employees alike are missing out on key benefits that can help people address those short-term, unexpected expenses.

We’ve seen that only about 15-20% of employees use EWA, and that usage tends to happen when something unexpected comes up. We don’t see a cycle of the same people using our service over and over again, in the way most people use payday loans.

Most use EWA for basic living costs such as food/groceries (66.9%), or transportation (46.6%).

With Branch, employers have a lot of control. Most employers allow a maximum access of up to 50% of earned wages. The average employee only takes about $70, indicating EWA truly does go to needed expenditures and emergencies.

Earned Wage Access is more than a perk— it’s become a must-have benefit in today’s labor market. When implemented thoughtfully, it empowers your workforce, improves financial stability, and enhances organizational performance with minimal disruption to existing payroll processes.

EWA platforms like Branch are free for you and offer plenty of fee-free options for your employees. Getting set up is easy—and we integrate with most modern payroll systems.

Branch also offers additional financial wellness tools like cashless tips and mileage, and more—so you can make faster pay part of your employee experience.

With EWA, you can offer employees a free benefit that not only addresses short-term needs, but can help them avoid long-term financial pitfalls like credit card debt or payday loans. You can send the message to prospective hires and existing employees that you care about their well-being—and they’re in good hands.

For today’s business leaders, the message is clear: providing earned wage access is more than a perk—it’s a strategic advantage in a competitive market.

Ready To Get Started? Chat With A Member Of Our Team.