Branch v. Instant: Which Solution is Best for Fast, Flexible Payments?

You probably already know the importance of offering fast, flexible payments to your workforce. Options like earned wage access (EWA), instant tip and mileage reimbursement, and fee-free paycard solutions all have the potential to help you recruit and retain more workers, in addition to helping them feel more financially secure.

Not only are these solutions beneficial for employees, but they can also eliminate the cost and hassle of issuing paper checks and dealing with cash. Switching to fast, digital payments is a move that just makes sense.

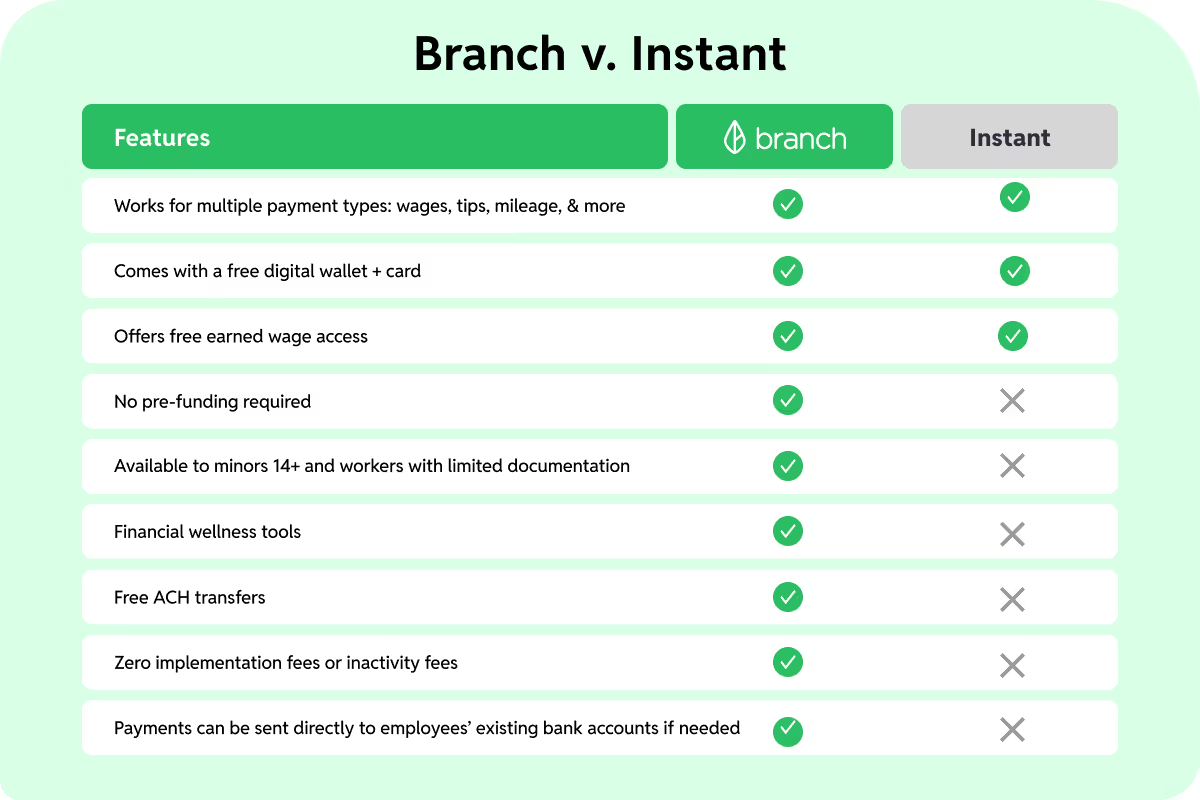

It’s not always easy, however, to understand which platform or solution will be the most beneficial for both your business and your employees. Today, we’re comparing Branch with Instant Financial to see how the two payments platforms stack up.

Branch v. Instant: Similarities

Works for multiple types of payments

Let’s start with the similarities between Branch and Instant. Both options offer fast, flexible payouts of wages, tips, mileage reimbursements, and other one-off payments such as last day pay, bonuses, stipends, and more. This allows you to offer the type of seamless payment options your workers will benefit from the most, helping them access their earnings faster. Both Branch and Instant also offer the option to provide earned wage access (EWA) to your employees.

Earned wage access (EWA) provided

This popular payment solution allows employees to take an advance of their own earnings ahead of payday if needed. EWA can help employees cover unexpected expenses and better manage their personal finances. Both Branch and Instant offer earned wage access as a payment option for your employees.

One caveat: Branch can offer EWA to organizations with 500 or more employees, while Instant requires a company to have at least 1,000 employees.

Provides a digital wallet and card solution

Both Branch and Instant provide workers with an app-based digital wallet and card solution that’s backed by an FDIC-insured checking account. However, there are some differences in what actions can be done within accounts, where money can be sent, and potential fees—which we’ll get into in a minute.

Branch v. Instant: Key Differences

Pre-funding account required

While exploring ways to offer fast, flexible pay to your employees, you may have heard about pre-funding—and that’s because it’s a common practice for many of our competitors. Pre-funding requires companies to tie up capital in a separate account in order to fund payments to employees, for everything from earned wage access to instant tips or disbursements. Instant is one of those platforms, requiring a pre-funded account when issuing payments.

Branch, however, does not require pre-funding. We front the money needed to pay workers and get reimbursed later on, instead of requiring you to hold money in a separate account to use our services.

A quick note on pre-funding: What makes it such a pain?

Pre-funding takes extra work, period. And unfortunately, the more employees and/or locations you have, the trickier and more time-consuming it becomes. Imagine having to pre-fund an account for multiple locations or franchise units, all while trying to plan ahead for a busy weekend where your employees will see a surge in tips. Attempting to predict how much to pre-fund that account with isn’t an exact science. And if the account runs out of money, Instant requires you to make an emergency deposit to cover the amount, which comes with an additional charge.

Keep it simple with a solution that handles this headache for you. Branch doesn't require pre-funding to send any payments, meaning you have one less issue to worry about.

Fee structure

It’s crucial to understand the fees a platform charges for both companies and employees before making your decision. There can sometimes be hidden payment fees that can add up for your employees, or charges to your company for simply using the platform.

Instant charges an implementation fee to get started with their solution, as well as inactivity fees up to $5.00 per month per employee after 90 days of inactivity. Instant also charges $2.75 per ACH transfer if employees want to send money to external accounts.

Branch does not charge implementation or inactivity fees, nor do we charge a fee for standard ACH transfers. We’re free for companies and have multiple fee-free options for workers, allowing them to send money to other accounts for free via ACH transfer.

Payments can be sent directly to existing accounts

With Instant, you can only send money to workers’ Instant Wallets. Payments are sent directly to worker accounts and they must pay a fee if they want to send money elsewhere.

With Branch, we offer multiple ways to pay out employees and multiple ways for them to use their money. You can send funds to Branch accounts—where they can spend directly from their Branch account and card—or transfer to external accounts. But you can also choose to push payments directly to an employees’ existing bank account via Branch Direct. This optionality gives your workers more freedom over how they get paid, providing the added flexibility and control that today’s workforce demands.

Availability for minors 14+ and workers with limited documentation

As you’re searching for a way to offer fast, flexible pay, you want to make sure it’s a solution that works for as much of your workforce as possible. Unlike Instant and some of our other competitors, Branch can be offered to minors 14+, unbanked workers, and workers with limited documentation.

This is because we offer two types of accounts: Essential and Premier. Premier offers full functionality of the Branch Wallet and Card, while Essential accounts are available for workers who may be unable to complete the traditional KYC (Know Your Customer) process. We can also support minor employees as young as 14 years old, helping you offer beneficial financial services to more of your staff.

Comprehensive financial wellness tools

While many of our competitors offer fast digital payments, Branch also comes with practical, free tools designed to help employees boost their financial wellness. These include:

- Personalized spending insights to help your workers better manage their finances

- A savings goal feature so workers can set aside funds for a rainy day if they choose

- A curated financial marketplace where workers can peruse offers tailored to their financial needs, from refinancing options to student loans and more

- A dedicated resource hub complete with financial literacy content to help employees build financial confidence

Providing this type of financial support to your workforce is more crucial than ever. In a recent survey, 92% of employees say they’re seeking additional financial support resources from their employers. When you can deliver this support, everyone wins.

Offering fast, flexible payments with a platform that benefits everyone

Both Branch and Instant allow you to pay your workers their wages, tips or mileage, and even earned wage access if you choose. But these two solutions have substantial differences, including the option to send payments to a worker’s existing bank account, the fee structure for both your employees, and the need to pre-fund accounts. When choosing between Branch or Instant to offer fast, flexible payments to your workforce, consider your options carefully to find the platform that can benefit both your business and your employees.

Learn more about the Branch app & card

Continue reading

Unlock a Happier, More Productive Workforce